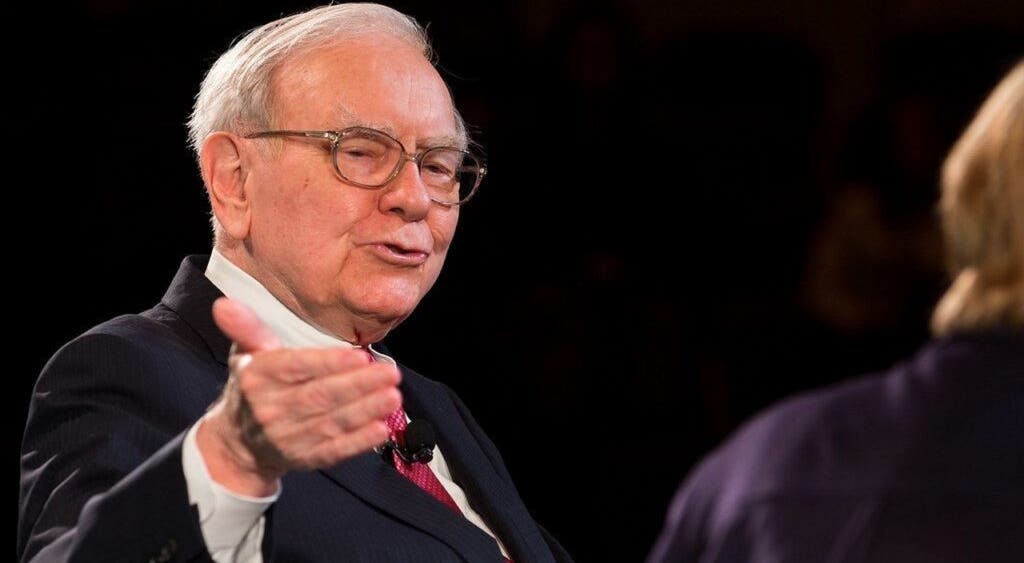

Warren Buffett's Warning: Are You Prepared for a Potential 50% Stock Market Plunge?

Once again, the stock market is facing significant losses. The Nasdaq has dropped to its lowest point since 2020, the S&P 500 is showing substantial declines, and investors are now in a frenzy. Recession fears , concerns over inflation and policy uncertainties have left Wall Street feeling uneasy.

But Warren Buffett He has been through this before. If past experiences are anything to go by, he would say that panicking now isn’t helpful; instead, one should focus closely on what’s happening.

Fear Is Your Greatest Adversary

Buffett has dedicated years to advising investors that adverse conditions frequently present their greatest opportunities. At the height of the 2008 financial downturn, he wrote an article Opinion piece from The New York Times entitled "Purchase American-Made Products. This Is Personal for Me." The stock market was plummeting, with fear reaching unprecedented levels, but Buffett was still making purchases.

Don't Miss:

- This battery spinning at 12,000 RPM with over $100 million in letters of intent could be the key component for sustainable energy—here’s why early investors are rushing to invest before funding ends.

- The hidden asset in billionaire investors' portfolios that you likely still don’t have. Identify which asset class has exceeded the performance of the S&P 500 during the period from 1995 to 2024 – and with almost no correlation.

Why? Because, as he put it, "bad news is an investor's best friend." Economic downturns bring stock prices down, giving long-term investors the chance to buy great companies at a discount. The trick isn't predicting what the market will do next—it's understanding the difference between price and value.

The Error of Focusing Exclusively on Markets

Buffett consistently rejects the notion of attempting to time the market. He stated, “Will equities fall over the next days, weeks, and months? That’s not the right question...largely due to its complete unpredictability.” Instead, what truly counts is determining if shares are being sold at prices below their intrinsic value.

And he's been right The S&P 500 continued to decline following his 2008 opinion piece, decreasing an additional 26% until it eventually reversed course in March 2009. However, individuals who heeded Buffett’s advice and purchased stocks amid the turmoil ultimately saw substantial returns over the subsequent years.

In Trend: The Number of Dogecoin Millionaires Is Rising – Investors holding over $1 million in DOGE uncovered!

Fear vs. Opportunity

Buffett has a simple rule: "Be fearful when others are greedy, and be greedy when others are fearful." That lesson has held true in every major market crash, from the Great Depression to 2008 to COVID-19.

At Berkshire Hathaway's (NASDAQ: BRK , BRK.B)) 2020 shareholder meeting , Buffett compared fear to the virus itself: "Some people are more subject to fear than others." He argued that some investors "really shouldn't own stocks" because they panic when prices drop and sell at exactly the wrong time.

"You've got to be prepared, when you buy a stock, to have it go down 50%—or more—and be comfortable with it, as long as you're comfortable with the holding," he said.

Trending: If You're Age 35, 50, or 60: Here’s How Much You Should Have Saved Vs. Invested By Now

The Real Risk? Holding Cash

Despite numerous investors seeking refuge in cash as a safe haven, Buffett advises against this strategy. He stated in 2008, “Individuals holding cash equivalents nowadays may feel at ease; however, they should not.” The diminishing purchasing power due to inflation degrades the worth of cash, whereas stocks generally yield better returns over an extended period.

Despite Buffett's widely known aversion to keeping large amounts of cash, Berkshire Hathaway now has an unprecedented $350 billion in reserve. believe this signals Buffett views the market as overpriced and is awaiting a decline so he can be ready to use that money when shares get cheaper, similar to what he has done during previous economic drops.

His guidance was to emulate the thinking of a legendary hockey player. Wayne Gretzky "I skate toward where the puck will go, rather than where it has been." Market trends precede shifts in sentiment and economic upturns. By the time everything feels secure, most significant gains have already passed.

Refer To: BlackRock refers to 2025 as the year of alternative assets. A New York City-based company has discreetly assembled over 60,000 investors who have collectively entered into an alternative investment category that was once reserved for tycoons such as Jeff Bezos and Bill Gates.

Buffett's Advice: Maintain Your Strategy

Buffett does not claim to have insight into what the market might do in the next day. However, he understands that historically, staying committed to investments has paid off over extended periods. In 2008, he forecasted that many significant corporations would achieve record profits again five, ten, and twenty years down the line.

And time and again, history has shown he was correct.

In the end, stock investment may not be suitable for everybody. Not all individuals possess the risk tolerance needed to handle significant drops in the market, and this is perfectly fine. Other options do exist. There are numerous methods for amassing riches. , and for those who favor stability, more secure choices such as bonds or diversified index funds could be a preferable option. It’s essential to understand your personal financial comfort level and make decisions that sync with your long-term objectives.

Read Next:

- A lot of people are taken aback by Mark Cuban's guidance for lottery jackpot recipients: Should they opt for cash or an annuity?

- Warren Buffett has stated, "Should you fail to discover a method for generating income as you slumber, you'll end up working till your last breath." Here’s how you can generate passive income starting with as little as $100.

© 2025 . does not offer financial guidance. All rights are reserved.

SPONSORED

Navigating retirement can pose challenges, and a financial advisor can provide assistance. Locating a competent financial advisor it doesn’t have to be complicated. SmartAsset's free tool connects you with up to three local financial advisors, allowing you to schedule free consultations with them. This way, you can choose the best fit for achieving your financial objectives once you've spoken with each match. If you’re prepared to locate an advisor who will assist you in reaching your monetary targets, get started now.

This article Warren Buffett stated that 'bad news is an investor's best friend,' and if you're not prepared for stocks to fall by 50%, investing might not be right for you. originally appeared on .

Comments

Post a Comment