The Psychology Behind Bitcoin Hodling: Why Investors Stay Steadfast During Crashes

Key Takeaways

- Hodlers inherently reduce circulation and impose scarcity beyond what the code dictates, as they form the true economic foundation.

- Volatility reinforces determination rather than diminishing it; downturns frequently boost loyalty instead of prompting departures.

- The psychology of Bitcoin is decentralized, yet synchronized stories take over the role of leaders and guide overall market actions.

- Keeping hold of assets is not passive; it represents a form of behavioral defiance against traditional financial systems, inflation, and centralized monetary authority.

Participants in the Bitcoin market have consistently recognized that volatility is a characteristic rather than a defect. During upward price movements, significant declines are not unusual occurrences. Instead, these corrections represent a regular trend seen throughout various cycles starting from 2010. Regardless of the continuous volatility In 2025, the conduct of long-term holders stays unchanged: they refrain from selling.

This behavior, often referred to as "hodling," has transcended being just a strategy; instead, it has become an integral part of both the behavioral patterns and culture within the Bitcoin community among Bitcoin enthusiasts.

Holding onto cryptocurrencies is frequently disregarded as illogical by individuals who are anti-crypto or fail to grasp how Bitcoin serves as a safeguard for the future against continuous monetary inflation. Actually, volatility is an intrinsic aspect of both the technological and cultural foundation of Bitcoin.

To grasp why individuals invest, we should move past graphs and delve into the deeper aspects of the psychological framework supporting the Bitcoin market.

The Evoluion of Hodling

Hodling Started as a mistake but transformed into a conduct guideline. It shares minimal similarities with conventional buy-and-hold approaches. It doesn’t stem from portfolio theory or technical analysis Rather, it’s a cultural phenomenon rooted in education, communal actions, common narratives, and symbolic belief.

Hodling Bitcoin through extreme volatility It's not a sign of indifference; rather, it's an active choice to abstain from engaging with short-term trading strategies.

Holding onto Bitcoin signifies a deep-seated conviction that its long-term path will not just be upwards but revolutionary, paving the way for a future where monetary transactions won’t rely on trusting traditional institutions but instead function through code. Once trust evolves into a component of the system itself, rather than being essential externally, the resulting economic and social benefits become significant and clear.

Once money no longer relies on trust, it transforms into something programmable, accessible without permissions, and resistant to corruption, thus enabling a higher degree of economic collaboration. To numerous individuals, keeping hold of their bitcoins isn’t so much focused on how Bitcoin might evolve but rather on personal growth through ownership. This act morphs into part of one’s self-identity.

The Significance of Patience in Bitcoin’s Market Ethos

In the majority of financial systems, managing volatility is considered a risk. Bitcoin , volatility has turned into an expected challenge. Market corrections not only jolt portfolios; they also serve as validations. community Resilience turns every significant downturn into a cultural milestone.

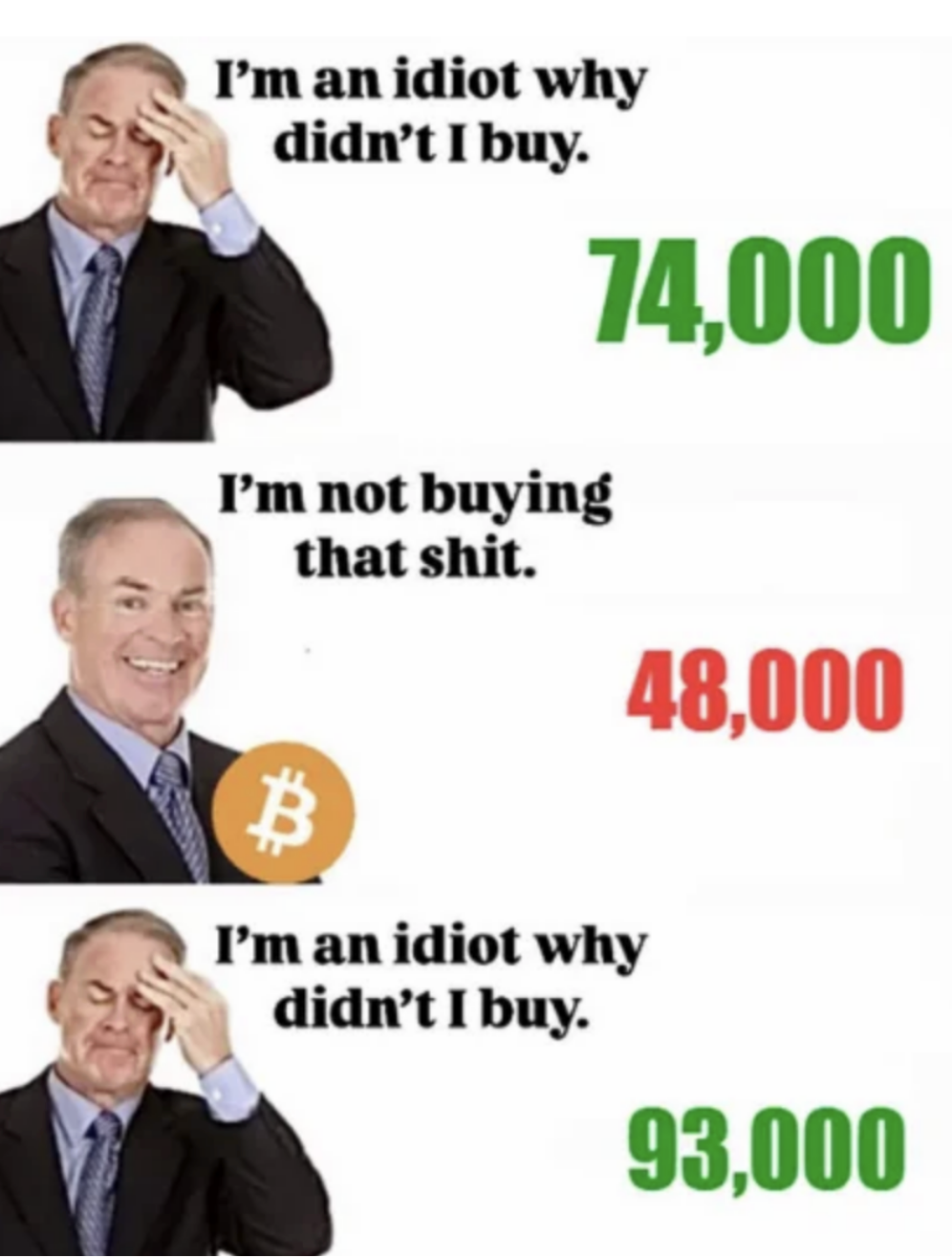

People who stay invested are known as "diamond hands" and are praised rather than sympathized with. Selling off when prices drop is typically seen as a misstep. Holding onto assets becomes a sign of trustworthiness. Each market cycle has demonstrated that individuals who maintained their positions throughout periods of decline and fluctuation, particularly those who bought in prior to significant upward movements, ultimately received disproportionately high rewards. For instance, someone who kept hold of Bitcoin since before late 2024 is currently experiencing substantial unrealized profits even after facing temporary losses.

Therefore, "diamond hands" aren’t merely a meme; they have actually surpassed the performance of actively managed investments over time. traders , particularly within Bitcoin’s larger market trends. In the realm of Bitcoin trading, patience tends to be more profitable than reacting impulsively. This reversal of conventional finance principles fosters a strong feedback mechanism. As volatility intensifies, it emphasizes the importance of remaining invested even further. This phenomenon goes beyond mere economics; it becomes a symbol of commitment as well.

The Function of Storytelling in Bitcoin’s Decentralized Messaging

Bitcoin does not depend on investor updates, corporate earnings calls, or institutional communications. Rather, it operates based on narrative momentum. This momentum comes from online forums, memes, catchphrases, and collective jokes which form an uncentralized communication system. Within this framework, the longest-lasting slogan has become "Hodl."

These narratives go beyond mere entertainment or motivation; they have a practical role. Memes and podcasts offer psychological stability amid uncertainties. They align expectations and transform volatile price fluctuations into organized collective actions.

In this scenario, memes serve as more than mere distractions; they function as mechanisms for market coordination. These visual jokes enable numerous scattered token owners to synchronize their actions cohesively, despite lacking centralized guidance.

How Does Holding On to Assets Enhance Scarcity?

The decision not to sell leads to genuine economic outcomes, indicating that with a limited number of coins for trading, each purchase or sale substantially affects the pricing. This occurs because individuals holding onto their coins decrease the circulating supply since they have no immediate plans to offload them.

This step generates resistance to price determination. It reduces fluctuations in distribution and helps establish long-term price supports. This phenomenon is not solely cultural; it has structural roots. Evidence of this can be seen in the available data. Il liquid supply continues to expand.

Inactive wallet addresses stay dormant regardless of market highs and lows, and exchanges are observing fewer coins being put up for sale, as illustrated in the graph below.

These holders aren't engaging in speculation but rather stabilizing the ecosystem.

Significantly, holding onto assets separates selling pressure from market cycles. As traders focus on short-term technical indicators, long-term holders frequently overlook chances for profit-taking and potential downsides. This leads to a distinct difference in how the market acts.

Over time, this difference molds Bitcoin's supply dynamics One group continuously cycles through price movements, while the other discreetly accumulates inventory and stabilizes the market bottom.

Why Bitcoin Holding Provides an Unbalanced Advantage for Individual Investors

Staking also attracts long-term investors due to the lopsided gains it offers, particularly for individuals who are outside conventional financial frameworks. To numerous stakers, Bitcoin isn’t merely a means to diversify their investments; instead, it represents an unparalleled chance to escape reliance on government-issued currencies or transcend the limitations imposed by income-dependent economies.

The word "asymmetric" describes a scenario wherein the possible increase in value or profit is considerably larger compared to the potential decrease in value or loss. For individual investors, keeping hold of Bitcoin over an extended period (not selling it) presents an "asymmetrical advantage." This is due to the fact that although the price of Bitcoin might show fluctuations in the near term (representing the negative aspect), the prospects for substantial growth in the future (indicating the positive side) far outweigh them.

For these investors, not selling early isn’t merely about passing up an opportunity; it’s also about dismissing the potential for growth and a brighter tomorrow.

Social Scarcity Versus Bitcoin Coding Scarcity

The code for Bitcoin ensures a limited total supply. 21 million coins , with the last fraction of a coin being mined by the year 2140. But what indeed gives that scarcity meaning is social behavior. Code alone cannot enforce discipline. Markets can always choose to disregard it. Holding is how scarcity becomes real.

Each individual choosing not to sell is engaging with an unofficial consensus mechanism. By holding onto their assets, they're actively influencing monetary policies via their investment choices. Individuals such as Michael Saylor give scarcity social weight—not through code, but by publicly demonstrating extreme holding conviction, turning Bitcoin's fixed supply into a cultural signal of long-term belief and monetary discipline.

This aspect of scarcity, driven by belief rather than rules, helps maintain Bitcoin’s character during volatile market phases, like the present decline in 2025. Recently, Bitcoin enthusiasts have faced a adjustment from $109,000 down to approximately $80,000.

Why Opting Out of Selling Bitcoin Is a Snub Against Traditional Finance Systems

There's also a subtle but powerful undercurrent to holding, which is resistance. Many participants don't view Bitcoin as a passive asset; they see it as a tool to opt out of inflation, centralized banking and systemic inequality.

Deciding not to sell goes beyond being merely a financial decision; it symbolically rejects outdated systems. This action serves as a declarative stance with repercussions extending well past the wallet And with every passing day, the count of HODLers grows.

This is precisely why market downturns typically strengthen rather than weaken commitments. Instead of eroding belief, volatility solidifies it further. story of Bitcoin Starting as far back as 2010, this isn't merely about increasing value; it's about distancing ourselves from traditional financial systems and getting ready for the imminent digital era that we're entering.

Bitcoin's Community-Driven Behavioral Rhythm

In contrast to conventional market cycles controlled by financial institutions, Bitcoin's activity pattern is driven by its community. Unlike these traditional setups, there isn’t a single leader making decisions; instead, it operates under the shadow of its enigmatic founder. Satoshi Nakamoto .

However, for some reason, large groups of participants act with uncanny coordination, purchasing during market downturns and amassing assets afterward. halving , and hesitating to leave during crashes .

This is not by chance; it stems from synchronized storytelling at the network level. Memes, social platforms, and persistent market legends establish a common point of reference that supersedes conventional hierarchical frameworks.

Just as Wall Street uses analyst calls and investor guidance, Bitcoin relies on cultural reinforcement mechanisms. Holding onto coins becomes the foundational principle influencing all market actions.

Bitcoin's Behavioral Pattern: Post-Announcement Downturns

By early March 2025, Bitcoin was trading close to $80,000, having experienced an abrupt 10% drop right after the announcement. Bitcoin Strategic Reserve The initiative launched by the White House had significant implications. However, despite the magnitude of this development, prices reacted in what appeared to be an opposing direction.

However, when viewed through the lens of market dynamics, this price adjustment is logical. This isn’t the first instance where Bitcoin has experienced a downturn following significant positive developments.

- CME Futures: Following the introduction of CME futures in 2017, a significant downturn occurred.

- ETF Approval: Following the approval, there was a "buy on rumor, sell on fact" response, causing Bitcoin to plummet significantly.

- Halving Corrections: Following the 2020 halving, the market moved horizontally for some time prior to an upturn.

Post-news corrections are integral to the behavioral framework. The price doesn’t immediately mirror fundamentals; instead, it mirrors the sentiment analysis cycles.

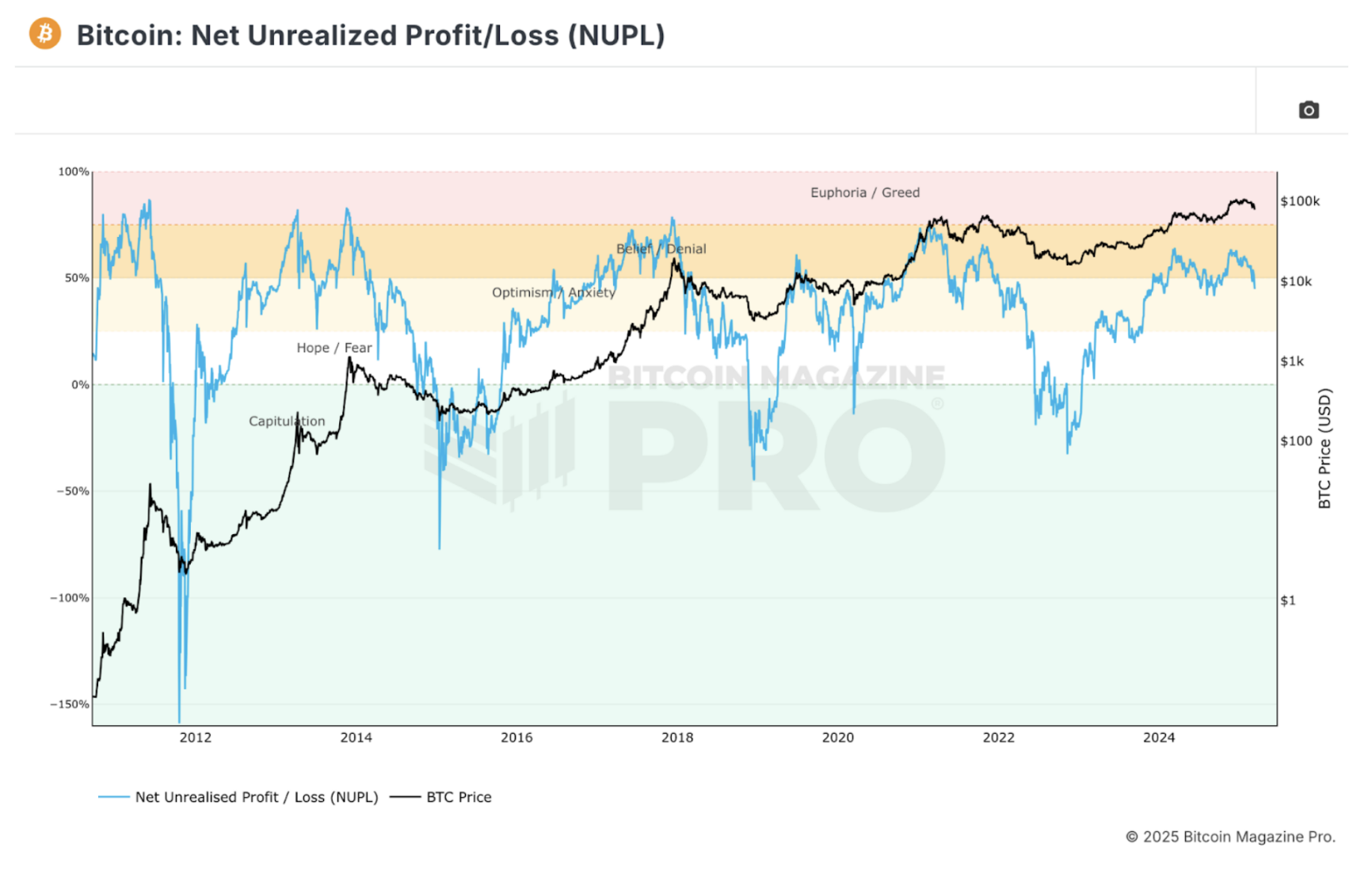

On-Chain Metrics Confirm Patterns in Bitcoin Market Sentiment Behavior

On-chain The data backs up this behavioral perspective. The Net Unrealized Profit/Loss (NUPL), which is a commonly tracked measure of investor sentiment, indicates that the market is presently within what has been termed an "Optimism/Anxiety" zone. Historically, this range signals transition periods during bullish markets.

The holders are staying in the market. Long-term wallets show little activity. There hasn’t been a widespread panic sell-off among short-term investors. This mismatch between price movements andholder actions underscores the notion that the core of the market stability relies more on psychology than purely technical factors.

Conclusion

The value of Bitcoin might change due to news events, but at its core lies a strong undercurrent: an unwillingness to part ways with it. This steadfast attitude isn’t random or ignorant; rather, it’s a deliberate action shaped by cultural influences, motivated by imbalances, and organized through rituals. Holding onto your coins throughout various market phases forms the fundamental support system for these cycles.

Cost indicates fleeting fluctuations, whereas holding embodies enduring rationale.

Bu konuda daha önce hiç bu kadar net bilgi görmemiştim.

ReplyDelete