Map Reveals Where Generation Z Can Actually Afford to Buy a Home

With the nation grappling with a persistent housing affordability issue that shows no signs of easing up this year, owning a home has turned into an unreachable aspiration for numerous Americans. especially young people.

Despite the fact that less than 10 percent of individuals under 30 possess mortgages across all major metropolitan regions in America, certain urban centers offer significantly better opportunities for Gen Z members and young millennials looking to purchase homes, as indicated by a recent study from LendingTree.

Many are located in the South and the Midwest, regions known for offering some of the lowest home prices across the country.

Why It Matters

The global economic recession caused by COVID-19 and the rise of inflation following the pandemic have eaten away at many young people's chances of saving money over the past few years.

While age 30 was previously seen as a significant benchmark characterized by milestones like starting a family and buying homes, numerous young Americans are compelled to postpone these aspirations due to the nation’s current housing affordability crisis. This situation stems from an unprecedented shortage of properties for sale coupled with elevated mortgage interest rates.

What To Know

According to a LendingTree analysis of anonymized credit data from its user base, just 3.1% of individuals below the age of 30 across the nation’s largest 50 metropolitan areas possess a mortgage. This implies that approximately 96.9% do not own one. Nonetheless, the proportions significantly differ depending on which specific urban area you look at.

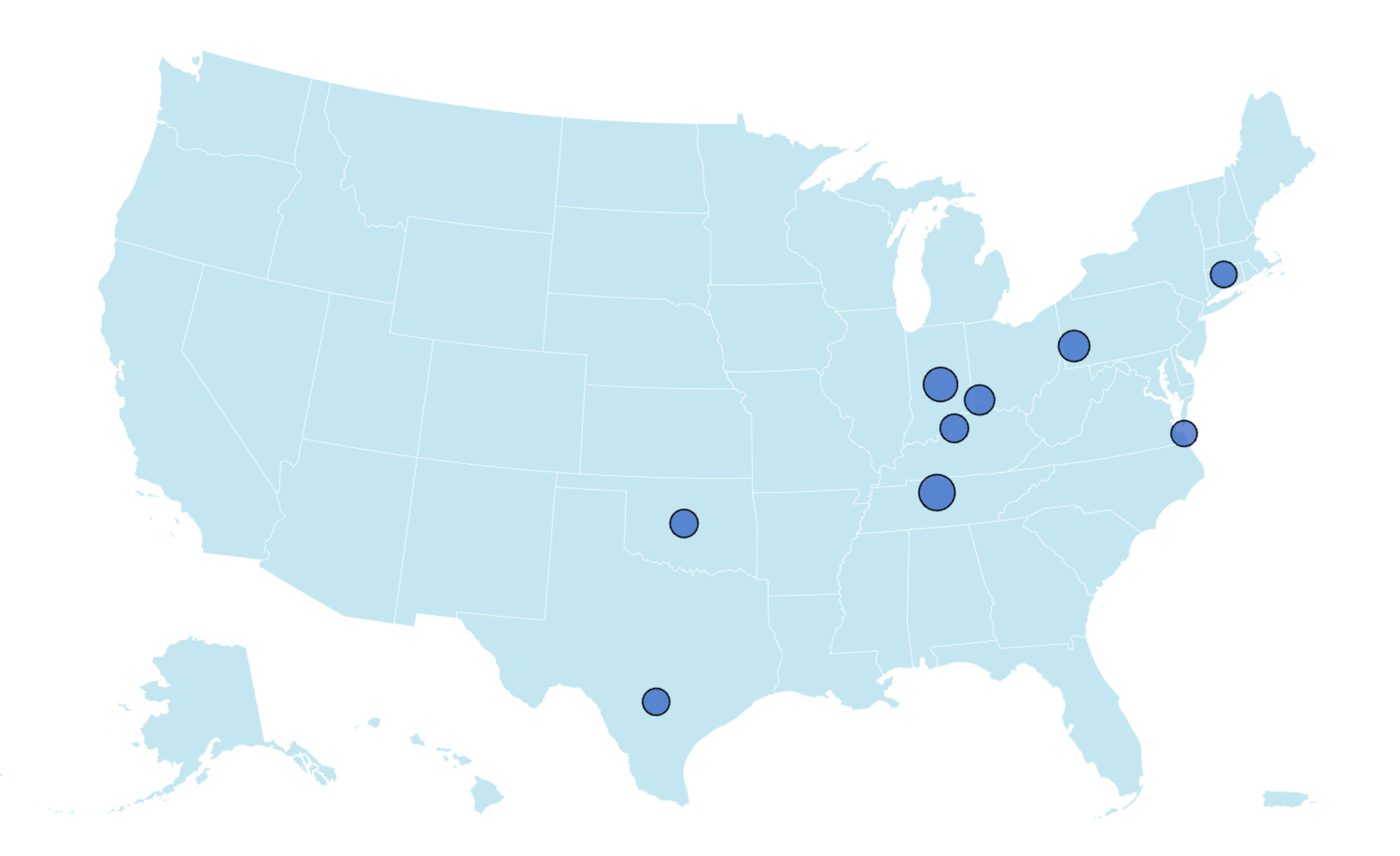

Here are the 10 metro areas with the largest proportions of under-30s holding mortgages, as per LendingTree data:

- Nashville, Tennessee: 9.4 percent

- Indianapolis, Indiana: 8.4 percent

- Pittsburgh, Pennsylvania: 7.0 percent

- Cincinnati, Ohio: 6.5 percent

- Louisville, Kentucky: 5.8 percent

- Oklahoma City, Oklahoma: 5.7%

- San Antonio, Texas: 5.3 percent

- Hartford, Connecticut: 5.0 percent

- Virginia Beach, Virginia: 4.9%

- Buffalo, New York: 4.7%

Matt Schulz, LendingTree’s chief consumer finance analyst, explained that the main factor behind these cities having the highest proportions of young homeowners is affordability. .

"Purchasing a house remains an unattainable fantasy for many individuals in their twenties living in places like San Jose, New York, and Los Angeles, despite the elevated salaries in these regions," Schulz stated.

Certainly, homes aren’t particularly inexpensive in Nashville, Indianapolis, and Cincinnati, yet their costs are significantly less compared to numerous major urban centers on the East and West coasts.

According to Redfin statistics, the median sales price for a home in Nashville stood at $475,000 in January, marking an increase of 8% from the previous year. Meanwhile, in San Jose, California—which has the lowest proportion of homeowners aged under 30—the median sale price reached $1.4 million, representing a rise of 11.9% over the same period last year.

Here are the 10 metro areas with the lowest percentages of individuals under 30 years old holding mortgages, based on LendingTree statistics:

- San Jose, California: 0.8 percent

- New York, New York: 1.2 percent

- Los Angeles, California: 1.3 percent

- Boston, Massachusetts: 1.4 percent

- Sacramento, California: 1.6 percent

- San Diego, California: 1.7 percent

- San Francisco, California: 2.0 percent

- Richmond, Virginia: 2.1 percent

- Portland, Oregon: 2.2 percent

- Atlanta, Georgia: 2.3 percent

In total, individuals under 30 years old account for just 4.7 percent of mortgage holders among the largest 50 metropolitan areas in the U.S., even though they represent 20.3 percent of the adult populace in these urban centers.

Why Millennials Find It Tough to Achieve Homeownership

Schulz stated that purchasing a home will generally pose greater difficulties for younger individuals compared to those who are older. Younger buyers often earn smaller incomes and possess poorer credit ratings, making it particularly tough for them to afford buying a house despite comparatively modest property values and interest rates.

Nevertheless, the current mix of elevated house prices and interest rates, persistent inflation, unprecedented consumer debt from credit cards, automobiles, and student loans, along with extremely high childcare expenses and various other monetary challenges, adds further difficulty.

Since the onset of the pandemic, home prices across the nation have been rising steadily due to an influx of suppressed demand coupled with a persistent scarcity of available properties in the real estate sector. This dearth can be attributed to insufficient construction of new residences following the subprime mortgage crisis in 2008.

Mortgage rates, which have shot up because of the Federal Reserve's aggressive rate hike campaign to combat inflation in 2022, are still hovering around the 7 percent mark, and specialists anticipate they will stay ranging from 6 percent to 7 percent both this year and in 2026.

Is Generation Z Faring Better Than Millennials?

Although millennials have experienced multiple financial downturns, have found it difficult to set aside funds and purchase houses Gen Zers are not automatically at an advantage.

"They're just in a different spot," Schulz said. "Millennials have aged into that very expensive time in life where they're making better salaries but aren't quite in their peak earning years. They're raising kids, paying for child care, trying to buy a house, needing to get a bigger car to handle their family, still working to pay down student loans and dealing with all the other expenses that come during that time."

Gen Zers, on the other hand, aren't there yet.

They earn less money, but they could potentially have fewer obligations as well," Schulz stated. "A positive aspect for Generation Z is that they can enjoy more free time.

Regarding finances, our most valuable resource is undoubtedly time. Starting to save, invest, and accumulate riches at an early stage proves advantageous. Although it’s not overdue to initiate later, commencing your journey sooner rather than later significantly impacts long-term success.

Related Articles

- Ukraine Conflict Map Reveals Russian Withdrawal on Multiple Fronts

- Carolina wildfire map highlights containment progress of fires

- Chart Reveals American States Imposing No Income Tax

- U.S. Electricity Costs Rise: Chart Highlights Highest-Priced Regions

Start your unlimited trial

Comments

Post a Comment